Executive Summary

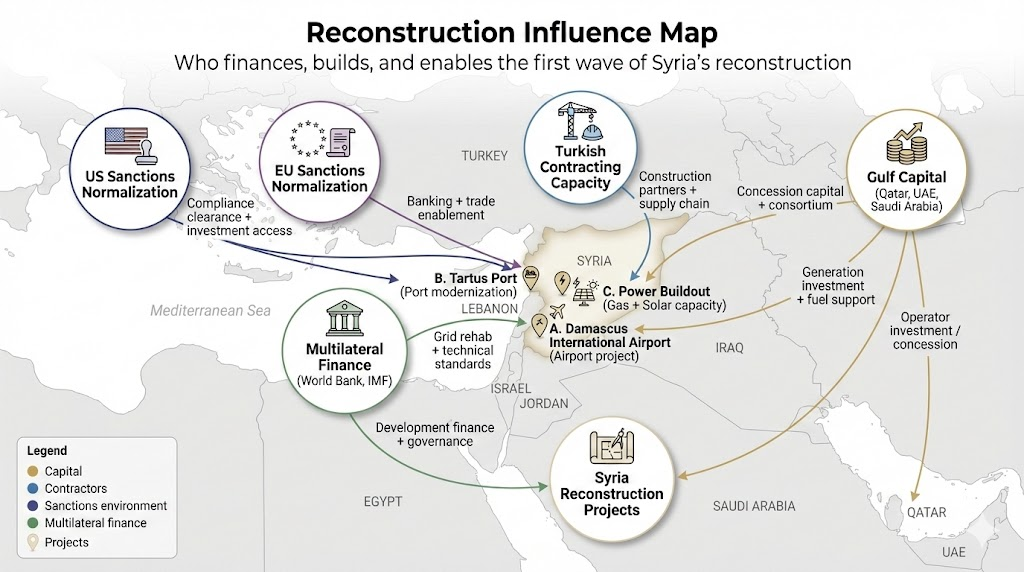

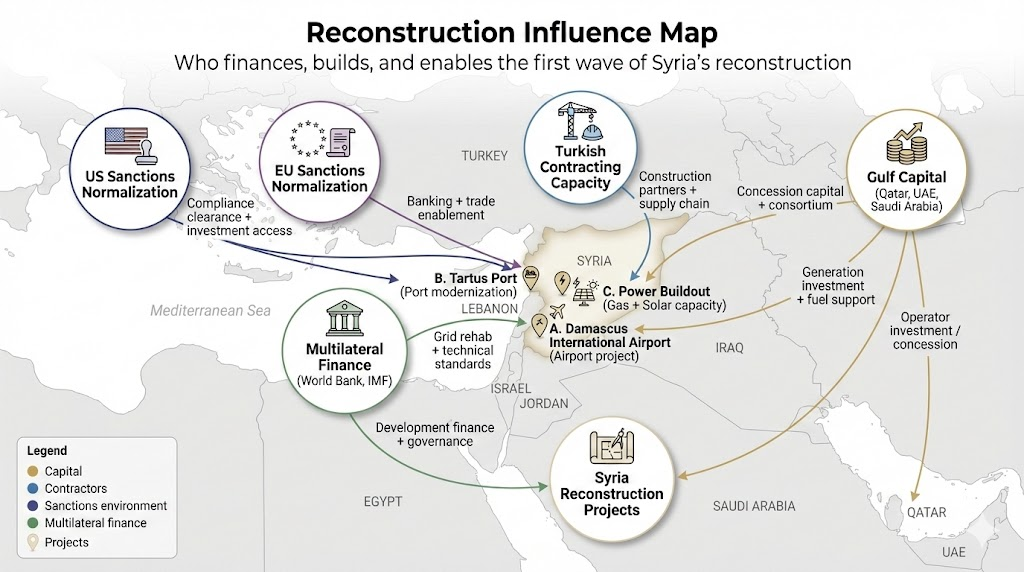

Syria's reconstruction is shifting from a humanitarian headline to a strategic rebuild cycle, with early anchor projects and sanctions normalization beginning to define who will finance, build, and operate the country's next economic foundation.

Overview

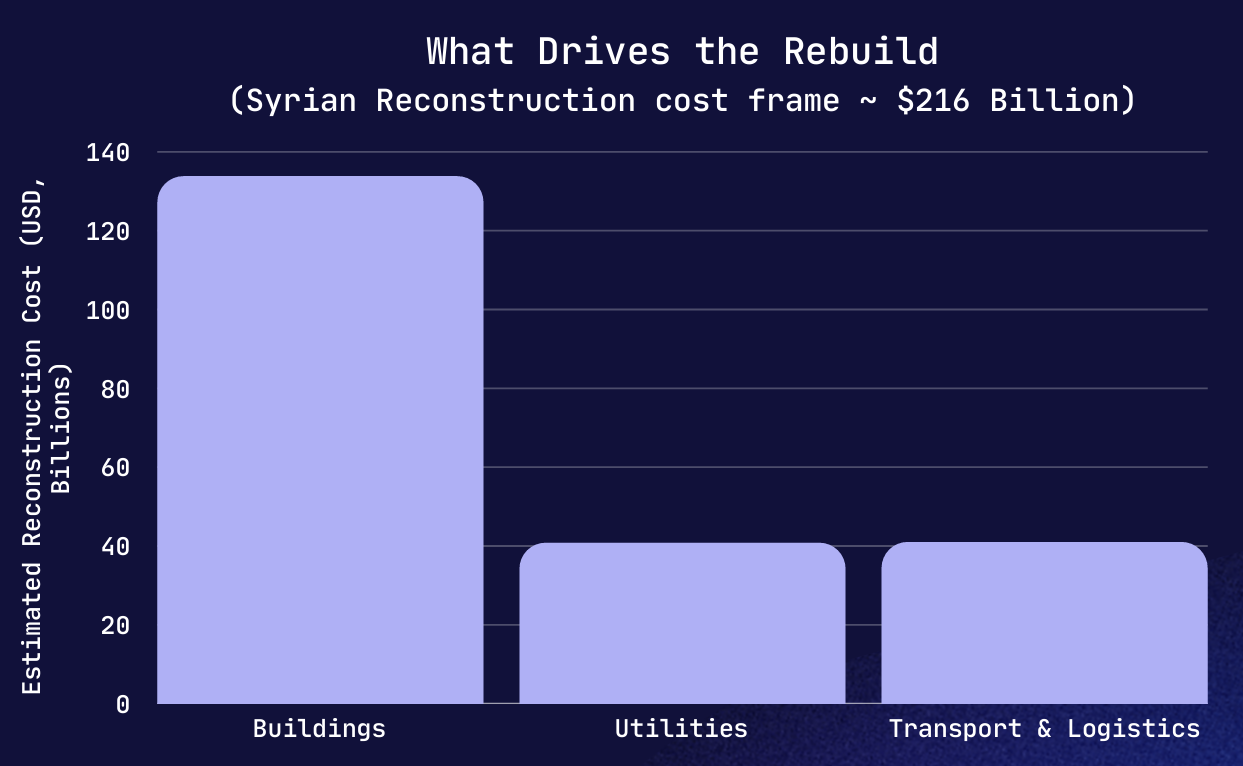

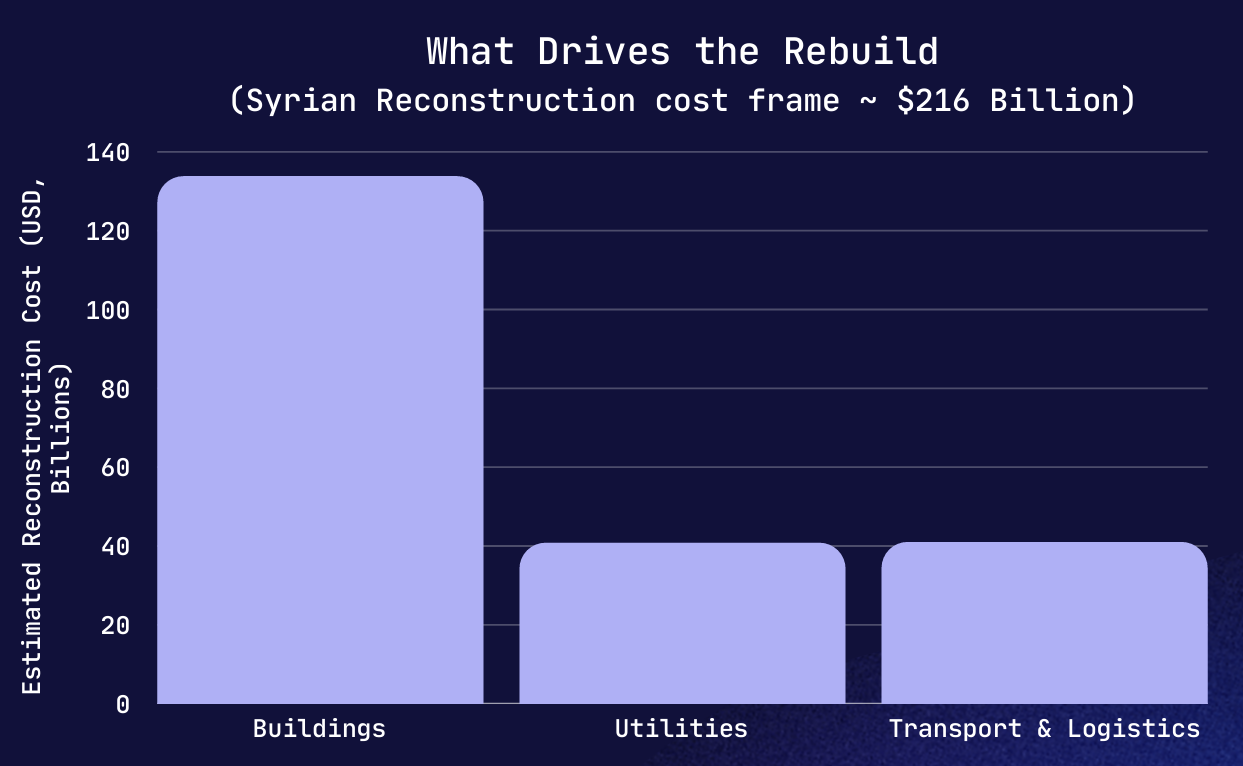

Syria is entering the largest reconstruction cycle in the modern Middle East outside of Iraq, with rebuilding needs now credibly quantified at a national scale and early anchor projects beginning to lock in. The World Bank estimates post conflict reconstruction costs at about $216 billion dollars across damaged infrastructure and building assets over the 2011 to 2024 period, establishing a baseline that will shape investor expectations, donor planning, and the first wave of major tenders.

What makes Syria different is that reconstruction is not only an engineering challenge. It is a geopolitical contest over who rebuilds, who finances, who operates critical nodes, and who captures the long run influence that comes with logistics corridors, energy infrastructure, and security relationships.

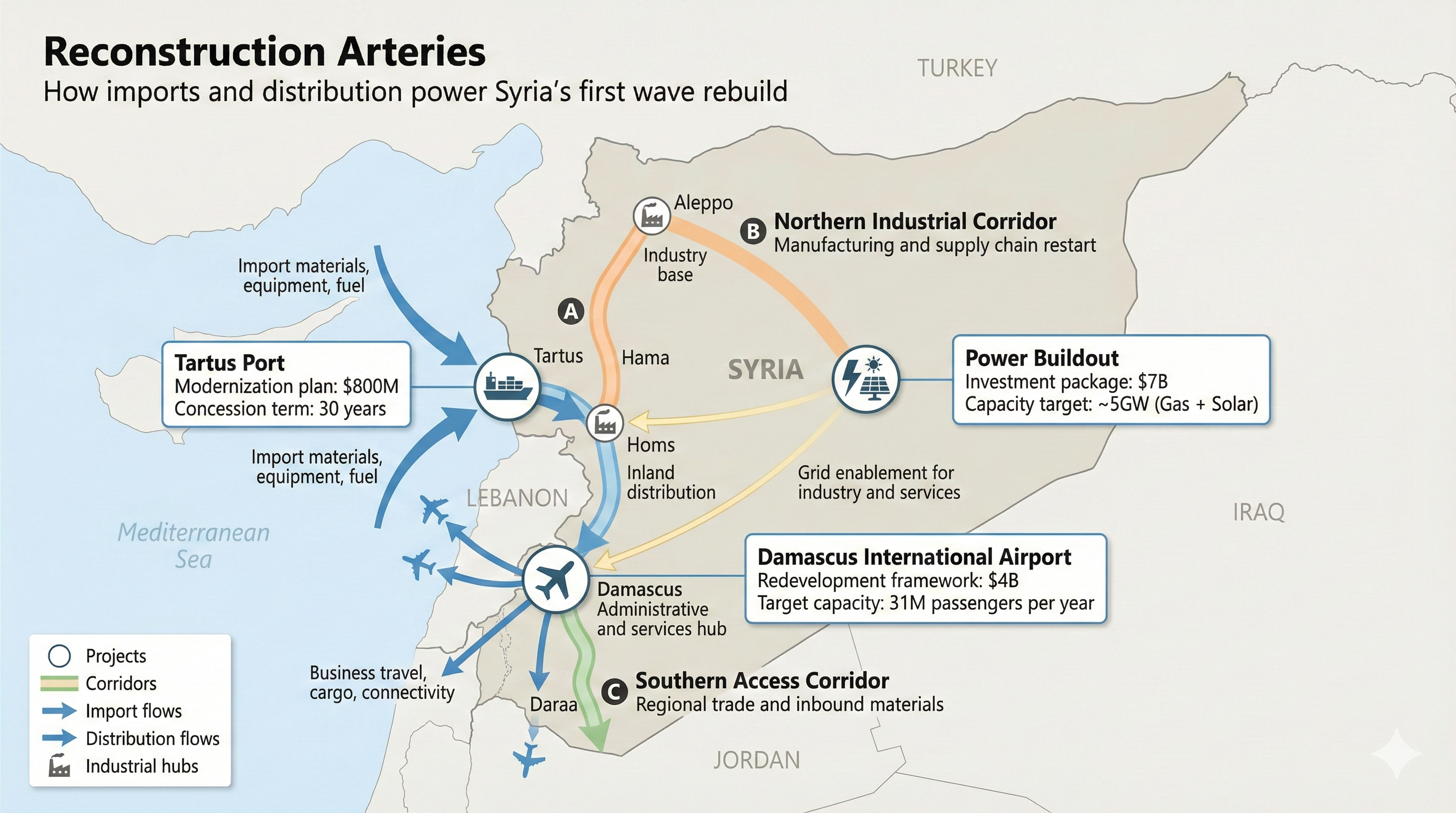

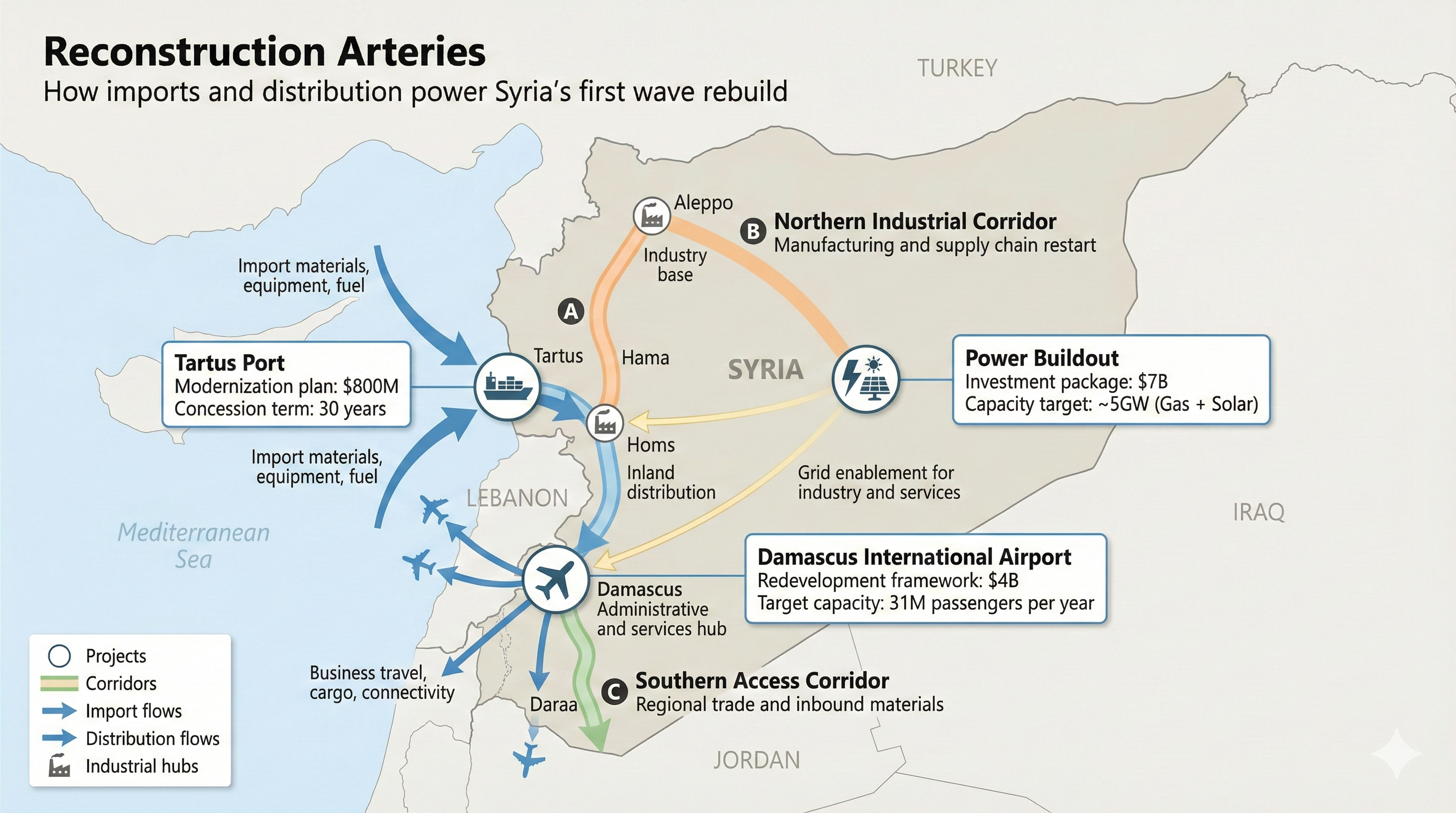

In 2025, a small set of highly visible deals signaled where early momentum is forming, including a multi billion dollar concession framework for Damascus International Airport, a 30 year $800 million dollar port modernization plan at Tartus led by DP World, and a Qatar led power package structured around 7 billion dollars and roughly 5 gigawatts of new generation capacity.

Shaping The Future

The near term is dominated by enabling infrastructure and sovereign backed concessions. The medium term expands into housing, industrial recovery, and services. The long term prize is Syria's reintegration into regional trade and energy networks, provided political stabilization, sanctions normalization, and domestic governance reforms stay on track. Sanctions relief is advancing, including EU legal acts to lift most economic restrictive measures in 2025 and US movement toward repealing core Caesar sanctions provisions, but compliance and political conditionality remain central to deal execution.

The Scale of the Rebuild Opportunity

The Reconstruction Opportunity is Best Understood as Three Stacked Problems.

- The first is physical damage across buildings and infrastructure at national scale.

- The second is the collapse of service delivery, especially electricity, transport, and logistics.

- The third is the reintegration of people and capital after a decade of displacement, sanctions, and institutional decay.

A credible starting point for the physical rebuild is the World Bank's $216 billion dollar estimate, which provides an external benchmark that governments, lenders, and large contractors tend to treat as a planning anchor rather than a ceiling.

Energy Dynamics

Electricity illustrates why Syria's rebuild behaves like a systems project rather than a collection of isolated construction jobs. Syria's power sector lost most of its dependable capacity over the conflict, and in 2025 the country is attempting to jump start recovery through a coordinated package of new generation and fuel supply. Reuters reported a 7 billion dollar memorandum of understanding centered on four combined cycle gas plants totaling about 4,000 megawatts and a 1,000 megawatt solar plant, with timelines measured in years rather than months.

Separately, Qatar agreed to send natural gas through Jordan to lift daily power output by roughly 400 megawatts, a near term intervention aimed at preventing economic paralysis while large plants are built.

Logistics

Transport and trade nodes are the other early determinants of scale. Without a functioning airport hub and a modernized seaport, reconstruction inputs remain expensive and slow, exports cannot recover, and private capital stays cautious. That logic is already visible in the first wave of projects, where Syria's airport and port become the operating system for the rest of the rebuild rather than peripheral assets.

The Players and the New Bargain

Reconstruction attracts power because control over financing and operations often becomes control over long term leverage. In Syria's case, the post 2024 political transition and the changing sanctions environment are reshuffling which external actors can plausibly operate at scale.

The EU's 2025 decision to lift most economic restrictive measures and the US move toward rolling back Caesar sanctions are not just legal changes. They reshape what can be financed, insured, and banked, which in turn decides which companies can compete and which states can sponsor them.

Qatar & The Gulf States

The Gulf states are positioning as capital providers and concession sponsors, often through consortium structures that blend construction capability with long term operations. This is clearest in the Qatar linked packages around airport development and power generation, which use concession style frameworks rather than one off EPC contracts. These structures are designed to align political influence with recurring cash flows from operating strategic assets.

Turkiye

Turkiye's Syria policy is driven by proximity, internal security, and domestic politics. Ankara has spent years treating northern Syria as a strategic buffer, aiming to suppress cross border militant threats, constrain Kurdish armed autonomy near its frontier, and reduce the long run pressure of hosting one of the world's largest Syrian refugee populations.

Stability in Syria is therefore not framed in Ankara as charity or diplomacy alone, but as a direct input to Turkish security, border control, and social cohesion at home. This is why Turkiye's influence tends to show up first through logistics, contracting networks, and governance leverage in adjacent Syrian zones, rather than through symbolic capital deployments.

The 2024 battlefield transition further deepened the perception of Ankara as a decisive external actor. Reporting and analysis indicate that rebel planners kept Turkiye informed and believed they had received approval ahead of the offensive, even as Turkish officials have denied direct involvement and the precise degree of coordination remains contested.

Regardless of the factual dispute, the strategic result is clear. Turkiye emerged with expanded leverage over the post conflict trajectory, including the ability to shape security outcomes in the north and to position Turkish firms inside early reconstruction consortiums where speed of mobilization and regional supply chains matter.

Conflicting Interests

This growing role is now intersecting with an emerging Turkiye Israel friction in the Syrian arena. Israel's strikes and posture in Syria, alongside Ankara's backing of the new authorities and its growing footprint in reconstruction and security coordination, are increasingly described by analysts as competing influence architectures.

Financial Institutions

International financial institutions and donor frameworks remain essential for legitimacy, transparency, and basic service restoration. Even when Gulf capital underwrites headline projects, broader recovery typically depends on development financing, technical standards, procurement discipline, and local capacity building to avoid a reconstruction boom that benefits only a narrow elite.

Projects Shaping the First Wave

Damascus Int. Airport

Damascus International Airport is a signal project because it combines national symbolism with practical economics. In 2025, a Qatar led consortium framework was publicly presented as a multi phase redevelopment under a build operate transfer approach, targeting a capacity on the order of 31 million passengers per year and positioning Damascus as a regional hub again. The consortium's own public communication and regional reporting align on the broad contours: multi billion dollar scale, phased buildout, and long horizon operations.

Tartus Naval Port

Tartus Port is the clearest example of how Syria's logistics layer is being rebuilt through concession models rather than state led capex alone. DP World announced both a 30 year concession and a planned 800 million dollar investment to upgrade infrastructure and transform Tartus into a regional trade and logistics hub, and it later stated it had commenced operations at the port under that agreement. For Syria, this is not only about throughput. It is a bet that predictable port operations can catalyze industrial restart, reduce import friction for reconstruction materials, and eventually support export recovery.

Energy

Energy is where the numbers become most decisive. The Reuters reported 7 billion dollar power package aims to build roughly 5 gigawatts of new capacity across combined cycle gas and solar, while complementary gas supply arrangements are intended to raise generation quickly in the interim.

Together, these initiatives represent a strategy to unlock the rest of the economy by restoring a minimum viable grid for households, hospitals, factories, and logistics systems.

The Essentials

These anchor projects matter beyond their direct revenue because they reduce uncertainty at the system level.

They give investors a credible answer to four questions that stop deals in post conflict markets:

- can goods move

- can power stay on

- can money move through banks without legal risk

- can inputs reliably reach job sites once they arrive in country.

In Syria, airport, port, and power are the first three levers, but the fourth is the corridor network that connects them. Without predictable road and logistics corridors linking Tartus to Homs, Damascus, and the industrial north, reconstruction remains a set of disconnected wins where materials bottleneck, delivery schedules slip, and costs inflate at every handoff.

Corridor Stability

Corridors turn projects into a cycle. A modernized port lowers the cost of importing cement, steel, equipment, and fuel. Corridors move those inputs inland at speed, allowing contractors to price work with confidence and deliver on milestones.

Reliable power then converts construction into economic activity by keeping factories running, cold chains stable, and service businesses open. Airports complete the loop by restoring executive mobility, technical labor movement, and time sensitive cargo, which accelerates procurement, oversight, and coordination.

When these elements work together, Syria starts to look investable because risk shifts from unknowable to measurable, and capital can follow predictable flows rather than political speculation.

Just as importantly, corridors shape the geography of recovery. The early rebuild will cluster along routes where logistics are easiest, security is enforceable, and infrastructure can be restored quickly.

Where the Next Opportunities Sit

Construction & Housing

Construction and housing will absorb the largest share of spending because conflict damage is concentrated in buildings and urban infrastructure. The challenge is sequencing. Housing rebuild accelerates only after power, water, roads, and permitting systems become reliable, otherwise new units remain unlivable or unfinanceable.

Transport & Logistics

Transport and logistics offer high leverage opportunities because they reduce costs across every other sector. Beyond Tartus, the rebuilding of inland logistics, customs processes, and trucking corridors determines whether Syria becomes a high friction market or a transit economy.

Energy & Utilities

Energy and utilities remain the highest priority enabler sector. The 2025 package aims to lift capacity by a multi gigawatt scale, but the opportunity extends into grid modernization, metering, distribution losses, gas supply chain reliability, and solar deployment at municipal and industrial scales.

Telecom

Telecom and digital infrastructure are likely to emerge as a fast follower once sanctions normalization deepens and payment rails stabilize. In post conflict environments, telecom often becomes one of the quickest sectors to generate cash flow and productivity gains, particularly when paired with port and airport modernization that drives trade and movement.

Defense

The business reality is that reconstruction requires security services such as demining, perimeter systems for strategic infrastructure, border management capability, and counter terrorism capacity. US policy discussions continue to emphasize security conditions and the ongoing detention burden related to Islamic State fighters and camps in northeast Syria, which will remain part of the operating environment for years.

Outlook Across Time Horizons

Stabilize

From 2026 to 2027, the reconstruction story is about making Syria livable and investable again. That means stabilizing electricity supply through fuel deliveries and quick restoration projects, re opening logistics channels through ports and airports, and demonstrating early wins in public services that build confidence. The gas supply plan aimed at adding roughly 400 megawatts illustrates the kind of near term intervention that can change daily life while longer cycle plants are built.

Scale

From 2028 to 2032, the focus shifts to scale and compounding effects. If the 5 gigawatt generation buildout progresses and port operations mature, Syria can begin to attract broader private capital into housing, retail, light industry, and telecom. This phase is also where procurement discipline and governance determine whether reconstruction becomes inclusive growth or an extraction cycle captured by a narrow set of actors.

Transform

Beyond 2033, the question is not reconstruction but reinvention. Syria's long term upside is tied to whether it can re emerge as a functioning state with credible institutions and predictable rules, and whether it can convert its location into durable corridor value. The long term risk is that reconstruction produces impressive assets but fails to produce a stable investment climate, leaving Syria with islands of modern infrastructure surrounded by an economy that cannot sustain them.

Conclusion

The scale of Syrian reconstruction is no longer abstract. It now has quantified baselines and a visible first wave of anchor projects that reveal how the rebuild is being structured: long horizon concessions for strategic nodes, energy packages designed to unlock the economy, and a sanctions normalization path that will determine who can participate at scale. The 216 billion dollar World Bank estimate anchors the magnitude, while the airport, port, and power announcements reveal the early architecture of opportunity.

For Syria, the central strategic challenge is sequencing and legitimacy. Rebuilding must restore services quickly enough to stabilize society, while also attracting capital that can endure. For investors and business leaders, the key is realism: the opportunity is substantial, but it is gated by compliance, security, and political trajectory.

The projects now underway suggest a pathway where rebuilding can become self reinforcing, but only if bankability continues to improve and governance choices reduce, rather than amplify, the risks that destroyed Syria's economy in the first place.

Disclosures

This report is provided for informational purposes only and is not intended to constitute legal, financial, investment, tax, or other professional advice. Readers should not act on the basis of any content in this report without seeking independent advice from appropriately qualified professionals.

Nothing in this report constitutes an offer, solicitation, recommendation, or endorsement to buy or sell any security, financial instrument, investment product, or service. Any discussion of potential opportunities, projects, or market dynamics is presented solely for research and analytical context.

This report is based on publicly available information, estimates, and third party sources believed to be reliable as of the publication date. CG makes no representation or warranty, express or implied, regarding the accuracy, completeness, or timeliness of the information contained herein and undertakes no obligation to update this report to reflect subsequent events or changes in circumstances.

Certain statements in this report may be forward looking in nature, including projections, expectations, scenarios, or assessments about future conditions. Such statements are inherently uncertain and are subject to risks and assumptions, including political, security, economic, legal, regulatory, operational, and market factors. Actual outcomes may differ materially from any expectations expressed or implied.

Any references to sanctions, licensing, regulatory compliance, or other legal matters are general in nature and are not legal advice. Sanctions regimes and enforcement practices are complex and may change rapidly. Readers should consult qualified legal counsel and conduct independent diligence, including counterparty and transaction screening, before engaging in any activity that could implicate sanctions or related compliance obligations.

Syria and the surrounding region remain subject to heightened political, security, and operational risk. Conditions may evolve quickly and unpredictably, including through conflict escalation, governance changes, infrastructure disruption, or restrictions affecting travel, logistics, insurance, and financial services. These risks may materially affect the feasibility, timing, or economics of any project or investment referenced in this report.

References to third party governments, institutions, companies, projects, or trademarks are included for informational purposes only and do not imply endorsement, sponsorship, partnership, or affiliation with CG. All third party names and marks remain the property of their respective owners.

To the fullest extent permitted by law, CG disclaims any liability for loss or damage of any kind arising from the use of, reliance on, or interpretation of this report. Any reliance placed on this report is at the reader's sole risk.